About SAA:

SAA is an independent investment consulting firm that works exclusively with insurance companies and pooling organizations. Founded in 1994 by CEO Alton Cogert, our experience and focus enables us to help clients improve their investment process and enhance the value added by their portfolios; critical components of their business.

We provide insurers and pools with independent investment advisory services to aid their board members and staff in meeting fiduciary responsibilities, along with strengthening their investment program.

Our senior consultants are former senior investment executives at insurers and bring broad, deep expertise across the various lines of business. We have also worked with Pooling organizations for more than 20 years. We combine a knowledge of investments with an understanding of the insurance and pooling businesses.

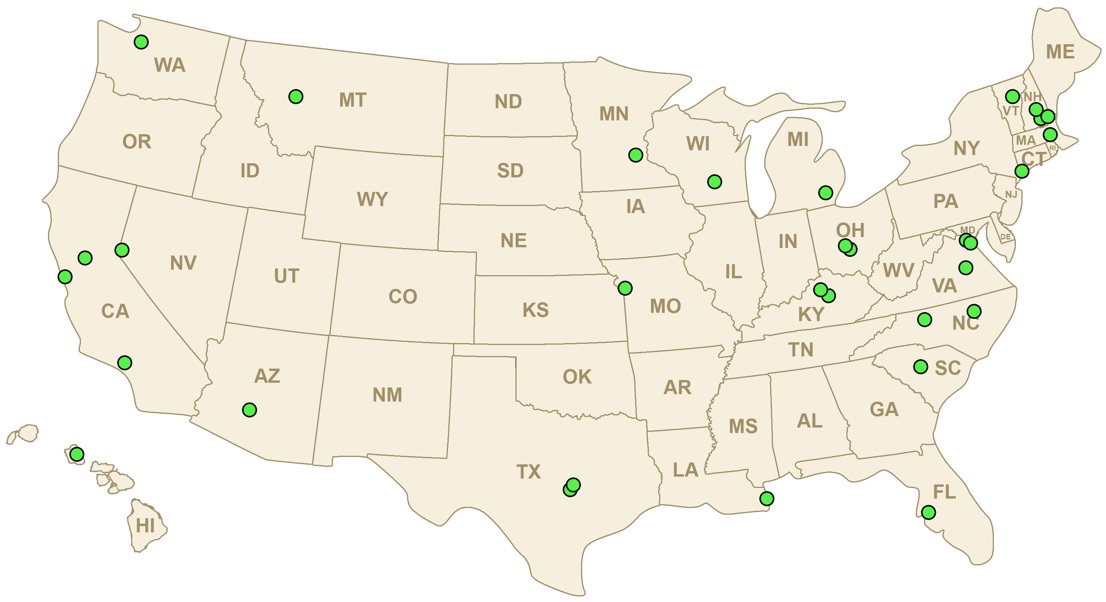

We are headquartered in Washington with an east coast office in Maine; with a staff of seven, including two senior consultants who are Principals of the firm, as well as two Directors in Florida and Missouri.

Who We Work With:

We currently work with 64 Insurance Companies within 34 Partner Client Relationships with assets under advisement of ~$11.1 billion spanning Commercial P&C, Health and Life carriers, and a number of Governmental Risk Pools/JPAs.

How SAA is Different:

Accessible & Responsive

You work directly with our Principals, who are former Senior Insurance Investment Executives, in a true partnership. Our consultants provide easy to understand, digestible communication with insights that are actionable, not superficial. While clients work directly with SAA's Leadership, insurers and risk pools also have the additional support of SAA's staff; acting as an extension of your organization.

Experience & Perspective

We only work with insurance companies & risk pools/JPAs and understand the best practices and common issues within the industry. SAA is independent and privately owned, meaning we have no conflict of interest with investment managers or receive any "behind the back" compensation (i.e. soft dollar).

We combine a vast knowledge of investments with a detailed understanding of the insurance and pooling businesses. We provide insight on industry best practices and guide clients in avoiding issues faced by many other insurers and risk pools

Adaptiveness & Resources

Our services are personalized and tailored to your organization’s goals, objectives, and structure. Our services are customized to ensure your investment process and structure is tied to your insurer or risk pool’s reserves, surplus, cash flows, and all other goals & objectives over the long-term.

Given our industry expertise, we have been able to develop several tools and resources for insurers and pools, such as our InsurerCIO website, Education Library, Fixed Income Manager Database, Risk Pool Peer Group, SAA Solutions Platform, and Insurer Investment Forum.

March 17-18, 2021

March 17-18, 2021

View Presentations / Learn More >>