March 23 - 24, 2022

March 23 - 24, 2022

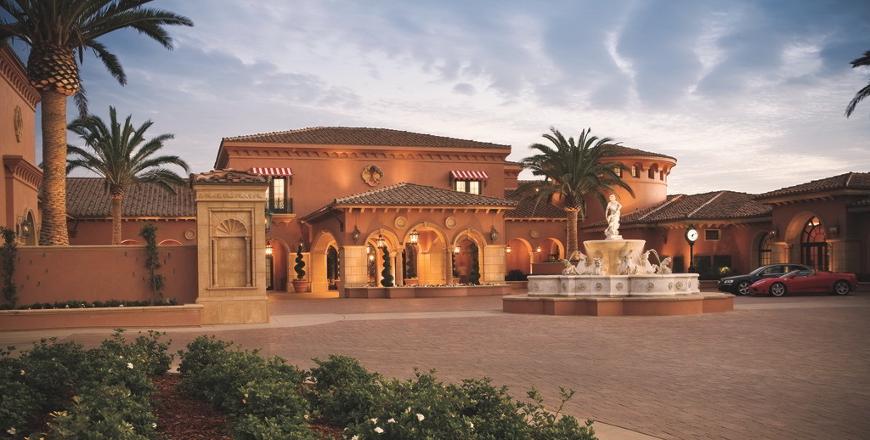

San Diego, CA

Learn More / Register >>

Case Studies: Insurer Investment Forum

The Case Studies presented at SAA’s Forum and Pools Seminar have been lauded for their clarity, applicability and usefulness by our insurer & risk pooling attendees.

We hope these sample case studies from previous Insurer Investment Forums provide better insight into the type of issues addressed at the conference, along with how attendees are able to collaborate with peers. You can view previous Pool Seminar case studies here.

The Insurer Investment Forum XXII will be held on March 23 - 24, 2022.

The Battle of Intergen: Balancing Low Rates, Risk Assets, and ESG

The Battle of Intergen: Balancing Low Rates, Risk Assets, and ESG

InterGen Insurance Company is a multi-line property/casualty insurer with $120 million in assets, $60 million in surplus and an investment portfolio of $100 million. That portfolio consists of $20 million in various Risk Assets (equity index funds divided 20% EAFE, 80% S&P 1500) and an $80 million investment grade bond portfolio with duration of 4.5 years and average credit rating of A-. The Company was founded twenty years ago, and is family owned.

InterGen is facing some of the lowest interest rates in US history. The difference between the book yield on their core fixed income portfolio and today’s market yield has widened to 200 basis points (2%). However, risk assets have provided some terrific upside returns, but at increased volatility and, correspondingly, increased downside risk.

To add to this situation, InterGen is regulated by the California Department of Insurance, whose Commissioner “has appointed the nation’s first Deputy Insurance Commissioner of Climate and Sustainability in the United States.”

Albert Intergen, Chairman, has convened a Board meeting to specifically discussing the following: