Insurer Investments: Safety, Alpha, Excess Yield in the Current Environment

We spoke with Belle Haven Investments to discuss the Fed and how its recent decisions have affected the Bond market, areas in the fixed income space to find diversification, and areas of concerns .

Dan O'Brien

| SVP, Head of Institutional Development and

Consultant Relations

|

Belle Haven Investments

obriend@bellehaven.com | www.bellehaven.com/

SAA: What is Belle Haven's near-term market outlook?

Belle Haven: In our view, many of the Federal Reserve actions have not filtered through the global economic system yet. However, with rates hikes of 225bp since March 2022, and more to come, they may just be starting to make their way through the economy. For example, in the US, forward-looking sentiments are the most negative they have been in at least 10 years for both companies and consumers. As companies continue to lower guidance, we expect earnings and margin deterioration to accelerate. On the global level, synchronized central bank actions to combat rampant inflation are starting to have a profound- effect on local economies, especially in EU, emerging, and developing economies. These countries, already suffering from exceptionally high food and energy costs, are nearing the brink of default and have needed to secure external funding from global agencies such as the IMF. Fundamentally, the global economy looks very fragile and about to tip over.

From a valuation perspective, we feel the corporate bond market is as complacent as it was back in the summer of 2021, despite the much higher degree of tail risks we are seeing in current environment. Given the fundamental and overvaluation risks, we are laying off the temptation to buy corporates and look for a better entry point. As Fed actions make their way through the economy, we would not be surprised to see high-grade corporate spreads widened out by 200bp. In the high-yield market, we would also not be surprised to see more defaults as credit spreads could reach recession-level widening in a short time period.

Comments from Fed Chair Powell in recent months have continued to trigger a risk-off mode. It is clear that while the Federal Reserve is data-dependent, the agency has left little doubt that it will do whatever it takes to bring inflation lower, including driving down overall demand and potentially pushing the economy into a deep recession. In our view, remain disciplined and focused only on the highest quality credits, rely on our curve positioning for managing duration, and utilizing our firm structure for trading execution, will help us navigate clients and partners through this difficult period.

SAA: How is Belle Haven positioning Fixed Income portfolios during this market?

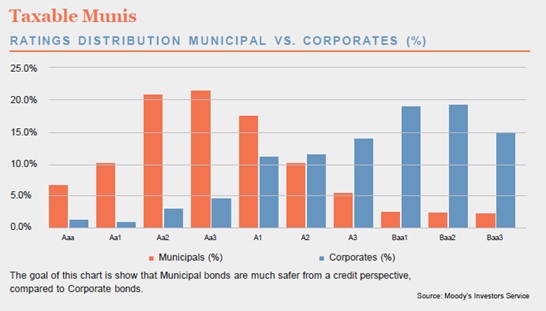

Belle Haven: We continue to see macro risks on a domestic and global basis as the capital markets are interconnected and weakness reverberates throughout all economies. We historically take a conservative approach with our strategies, utilizing less credit and duration risk versus benchmarks. We continue to be overweight taxable municipal bonds, and underweight treasuries and corporate bonds. In the near term, we continue to favor higher credit quality and overall portfolio liquidity. For context, there are only 12 AA corporate issuers within the corporate bond market, while over 50% of the entire corporate market has bonds rated BBB and below. We see this as a huge overall risk to the market. In contrast, over 80% of the taxable municipal bond market is rated AA or better (Please refer to chart below for illustration) In our view, corporate credit spreads have come in too fast too soon and do not reflect the risks in the macroeconomic environment.

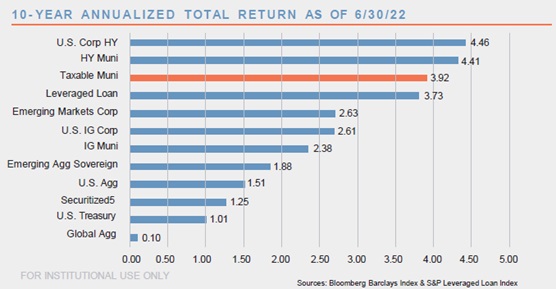

We view the taxable municipal market as a compelling place to diversify; given its defensive nature during economic stress, higher credit quality, low historic defaults, and higher relative excess yield. The asset class has performed very well over the last decade. On a yield basis, we continue to see compelling opportunities within the Taxable Muni market. Taxable Municipal bonds should widen less than corporate bonds, because of their strong credit quality and strong municipal balance sheets. State and local governments have been flush with cash from pandemic stimulus and their reserves funds continue to be near record levels.

We are currently seeing 30-40bps pickup in excess spread in 10yr AA taxable municipal bonds versus the 10yr AA US corporate bond market. It continues to be a buyers’ market, allowing us take advantage of our firm structure, and the dislocation in the secondary market. Banks continue to cut their balance sheets and reduce their bond trading exposures. We continue to monitor the markets, and we will take advantage of any dislocation within the corporate bond market.

The current yield curve environment remains inverted, as we focus on finding attractive curve points with value. We are limiting allocations inside 12 months, as the curve remains very steep in the first several months. We also find value in the use of agency bonds as implied treasury volatility continues to remain elevated. This allows us to capture compelling spread with short duration but increased liquidity and credit. Bonds priced off of the 2Y and 3Y treasuries remain very attractive in addition to the 7Y – 10Y. Outside of 10 years we are careful where spread differentials become very tight between years. Amid a potential slowing economy, we focus on value with steep parts of the curve and locking in attractive yield. The 7Y – 10Y part of the curve is a good example. After peaking at 3.47% in June there has been bond buying pushing treasuries lower. As the Fed continues to combat the hottest inflation in over 40 years, we remain committed to constructing portfolios that can stand the rigor of any type of market.

SAA: What keeps Belle Haven up at night?

Belle Haven: Even though the Fed is not the Sun, it might as well be the center of the universe given that the capital markets revolve around every single word it utters. Sure, there are challengers to the Fed’s status like Putin’s invasion of Ukraine or China’s highly restrictive policies to contain COVID19, both of which we feel have contributed a significant amount of inflationary pressures. However, in our view, nothing moves global markets like the Federal Reserve. With a single 10-minute press release at Jackson Hole, the Fed wiped out $1.25 trillion in market cap. Even though the Fed is top of mind, the secondary and tertiary effects that remain to trickle through the global economy, keeps us up late into the night.

Internationally, excluding what has been felt and continue to feel from the Russian/Ukrainian war, and China’s impact on the global supply chain due to its restrictive COVID policy, the dominoes are appearing to fall in emerging markets. Not only have the regions continue to deal with heightened food and energy costs, countries that are reliant on external (especially dollar based) funding are also being hit with much higher cost of financing of their country’s operational budget. We have already seen the IMF come to the rescue of Pakistan, with Sri Lanka next in line. How many other countries with unsustainable debt loads and nose-bleed inflationary pressures will surface if rates continue to increase?

Domestically, the line of sight and impact of Fed actions are more definitive, as evidence of the 20% equity market collapse in tech-heavy NASDAQ, and spread widening in credit markets. On the surface, the financial health of companies and consumers look to be rather resilient. However, the underbelly paints a different picture.

In the most recent quarterly earnings, companies on average, have met or beat estimates. But that is on the back of much lower and often revised expectations. To combat rising costs (especially raw materials, labor, and logistics), companies have significantly increased prices at the detriment of volume. At some point, price increases will (if not already) become so prohibitive for consumers that overall demand can come crashing down. Even management teams on their earnings calls are resoundingly negative about upcoming quarters. As rates continue to rise, highly levered companies that once relied on cheap funding and easy access to capital markets, can run into trouble and once again repopulate a rather barren bankruptcy environment.

But what about the consumers, aren’t they doing well? Yes. In general. The health of US consumers have held up well. The job market and consumption trends remain robust. However, we feel there is a lagged effect between higher rates and the eventual hit to consumers’ wallets. It may already be here as disposable income continues to slow and savings rates have reached the lowest levels since 2008. The so-called “good feeling” around household wealth seems to be wavering as the housing market enters its most challenging period since 2008. One of the troubling trends we are also seeing is the rise in credit card balances. Our worry isn’t the currently resilient consumer health, it is more a spiral downward when bankruptcies rise and financial institutions tightened their belt in terms of credit lending. We have already seen them add more in reserves for potential loan losses for upcoming quarters.

In this turbulent global economic environment, it is difficult to find events that do not keep us up at night. It is starting to feel like the other shoe has to drop before we can move beyond it. We remain true to our directive – focus on high credit quality, strong executions, asset classes with value, and solid curve positioning to help clients generate return and navigate through challenging times, as we have over the last 20 years.

Disclaimer: The contents of this commentary are intended for educational purposes only and are not intended to be relied upon as a forecast, research or investment advice nor should it be considered a recommendation, offer or solicitation for the purchase or sale of any security or to adopt a specific investment strategy. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. All opinions expressed in this newsletter are subject to change without notice. Nothing in this report should be considered tax or legal advice and investors should contact their tax professional for information regarding their tax situation.

Source: Strategic Asset Alliance, Belle Haven Investments. The information contained herein has been obtained from sources believed to be reliable, but the accuracy of information cannot be guaranteed.