How Should Insurers Respond to Rising Rates and High Inflation?

We spoke with Income Research + Management to discuss the current investment environment insurers and risk pools are facing and areas they can find potential opportunities.

Rob Lund

| SVP, Client Portfolio Manager |

Income Research + Management

rlund@incomeresearch.com | www.incomeresearch.com/

SAA: How should insurers be thinking about their investment portfolios in this current environment of rising rates and high inflation and where does IR+M see opportunity?

IR+M: At IR+M, we see great opportunities in fixed income amid this rising rate environment. Longer term, as book yields reset higher, investment income should improve, and insurer’s financial positions should strengthen.

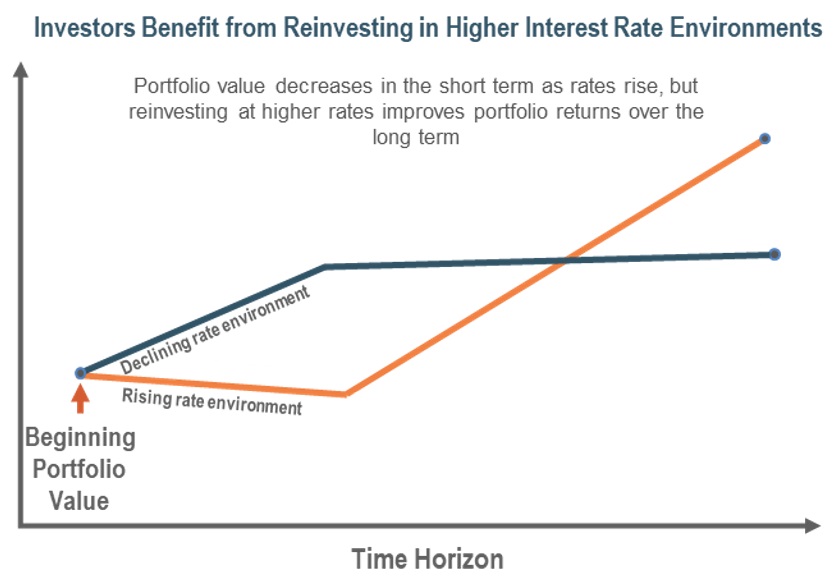

Maintaining a convexity profile in the asset base that is similar to that of the liabilities is becoming more important. As rates have risen, insurers with a more negatively convex asset profile may have found themselves with a mismatch in the duration of their assets and liabilities. In fixed income, if investors’ time horizons exceed their durations, they will benefit from rising rates because coupons and maturities will be reinvested at higher prevailing yields. It is through this view that we are especially excited about the current opportunities to add yield to the portfolio.

In this environment, we believe there are attractive relative value opportunities for insurers to optimize their investment portfolios. Higher yields and wider spreads create divergence and opportunities across sectors. Year-to-date, yields have risen almost 2% across most sectors and are well-above both the trailing 5- and 10-year averages.

We believe there are opportunities within corporates given strong fundamentals and attractive spreads. The yield differential between investment grade and high yield (HY) has widened, which may entice some insurers to increase allocations to HY, especially given the changing Risk-Based Capital (RBC) factors for life companies. With the rise in yields the value of the tax exemption on tax-exempt municipal bonds (munis) has also grown, creating more attractive opportunities within the sector. Munis are also broadly insulated from geopolitical crises and have generally outperformed other spread products during volatile and uncertain market environments. Within securitized, we see value in non-traditional asset-backed securities (ABS), commercial mortgage-backed securities (CMBS), and collateralized loan obligations (CLOs). Within ABS securities, we see value in non-traditional subsectors such as Whole Business, Datacenters, and Single-Family Rentals. We believe these subsectors offer insurers attractive yields and improved capital treatment given higher ratings while also providing diversification benefits and strong structural protections. Similarly, we see value in vintage non-agency conduit CMBS, as we believe this sector provides insurers with a diversified, up-in-quality approach and offers value in the short end given enhanced credit protection with minimal prepayment volatility. CLOs provide attractive relative value, particularly within the AAA-rated tranches. The structural strength of CLOs has proven out over multiple credit cycles.

Overall, we believe these are opportune times to be bottom-up bond pickers. Given that it is extremely difficult to predict the high in rates or play the yield curve, we “take what the market gives us,” which these days is higher rates and wider spreads. Buying good bonds when they are on sale usually works out as the cycle moves from downturn to recovery, and of course, markets discount this trend several months or quarters ahead of time.

SAA: Are there sectors that have historically done better or worse during a rising rate and high inflationary period?

IR+M: The Federal Reserve (Fed) began hiking rates in March in an effort to combat persistently high inflation and plans to continue to act aggressively. During a rising rate and high inflationary period, some sectors historically have performed better than others. Traditionally, the Energy sector has been supported by higher oil prices; however, Russia’s war with Ukraine has contributed to increased geopolitical volatility. The Financials sector often benefits from high inflation and rising rates, as banks and other lenders raise rates on borrowers, thus expanding their margins. The Health Care and Utilities sectors have generally outperformed since the increased volatility drives investors toward safer sectors.

Sectors that cannot mitigate the impact of price increases have usually underperformed. Consumer Discretionary, Industrials, and Materials tend to underperform during rate-hike cycles, as investors anticipate that high inflation and borrowing costs will negatively impact businesses and consumer spending. In an inflationary environment, the Consumer Staples sector, despite being defensive in nature, often faces diminishing profit margins without the pricing power to offset higher costs.

In this current environment, we favor those corporate issuers that are less prone to earnings volatility during weaker economic times. Money Center Banks, Capital Goods, Communication, Transportation, Utilities, and Taxable Municipals offer stability, attractive risk-adjusted yields, and defensive characteristics that should prove valuable amid an economic slowdown.

Sources: Bloomberg as of 7/19/22 unless stated otherwise.

The views contained in this report are those of IR+M and are based on information obtained by IR+M from sources that are believed to be reliable but IR+M makes no guarantee as to the accuracy or completeness of the underlying third-party data used to form IR+M’s views and opinions. This report is for informational purposes only and is not intended to provide specific advice, recommendations, or projected returns for any particular IR+M product. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission from Income Research + Management. “Bloomberg®” and Bloomberg Indices are service marks of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited (“BISL”), the administrator of the index (collectively, “Bloomberg”) and have been licensed for use for certain purposes by IR+M. Bloomberg is not affiliated with IR+M, and Bloomberg does not approve, endorse, review, or recommend the products described herein. Bloomberg does not guarantee the timeliness, accurateness, or completeness of any data or information relating to any IR+M product.

Source: Strategic Asset Alliance, Income Research + Management The information contained herein has been obtained from sources believed to be reliable, but the accuracy of information cannot be guaranteed.