March 23 - 24, 2022

March 23 - 24, 2022

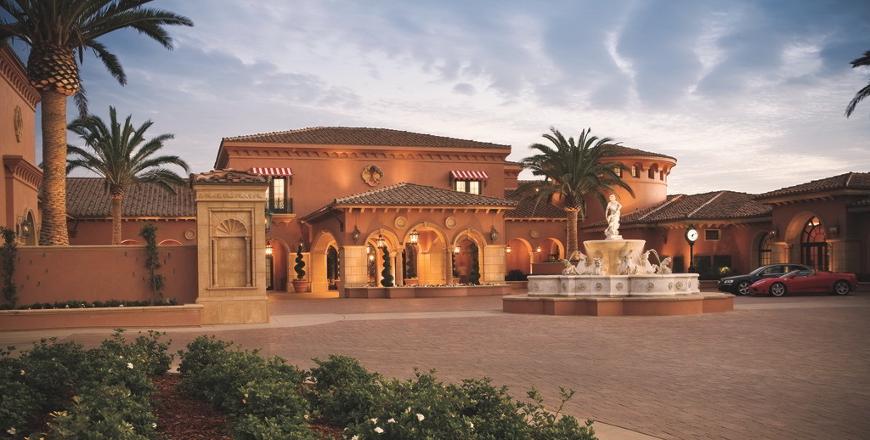

San Diego, CA

Learn More / Register >>

- Risk Pool Peer Database

- Key Issues: Q3 Review & Q4 Outlook

- Trustees: Fulfilling Investment Duties

- Case Studies: Pools Investment Seminar

- Investment Policy: Best Practices

- NLC-RISC 2023: Governing Your Pool’s Investment Process

- Investment Responsibilities of a Risk Pool’s Governing Body and Its Individual Members

Case Studies: Pools Investment Seminar

The Case Studies presented at SAA’s Risk Pooling Seminar has been lauded for their clarity, applicability and usefulness.

We hope these sample case studies from previous Pool Seminars provide better insight into the type of issues addressed at the conference, along with how attendees are able to collaborate with peers. You can view prior Insurer Investment Forum case studies here.

The next Insurer Investment Forum XXII will be held on March 23 - 24, 2022, with the Investment Seminar for Gov't Risk Pools taking place on the afternoon of March 23, 2022.

A Pool's Limited Opportunity? - Strategic Asset Allocation

A Pool's Limited Opportunity? - Strategic Asset Allocation

Tess is the new associate executive director and wanted to become familiar with the investment portfolio and how it supports the goals and objectives of the pool.

Tess compared a recent rebalancing study to the pool’s investment portfolio and a thought struck her – disconnection.

While implementation may be more difficult with certain asset classes, nothing in the state regulations precluded the pool from investing in any of the asset classes posed within these two intriguing items; however, the investment policy allows only U.S. equities.

At an upcoming Board meeting, Tess wanted to pose a few strategic questions for the Board and advisors about a potential change to the pool's current asset allocation.