- Risk Pool Peer Database

- Key Issues: Q3 Review & Q4 Outlook

- Trustees: Fulfilling Investment Duties

- Case Studies: Pools Investment Seminar

- Investment Policy: Best Practices

- NLC-RISC 2023: Governing Your Pool’s Investment Process

- Investment Responsibilities of a Risk Pool’s Governing Body and Its Individual Members

“Risk Pool Portfolios are Seeing Significant Unrealized Losses,

Now What?”

We spoke with AAM - Insurance Investment Management to discuss how risk pools might be able to react to the unrealized losses being seen across their fixed income portfolios, as well as impacts to the liquidity market risk pools should be aware of.

Dan Byrnes, CFA

| Principal, Vice President, Senior Portfolio Manager |

AAM – Insurance Investment Management

dan.byrnes@aamcompany.com | www.aamcompany.com/

SAA: How should risk pools think about their investment portfolio’s unrealized loss position?

AAM: In a report published October 10 by AM Best, they note that, in aggregate, publicly traded insurance companies reported more than $200 billion in unrealized losses on their bond portfolio. More than a quarter of publicly traded insurance companies have lost more than 20% of year-end 2021 shareholder’s equity due to the impact of rising interest rates(1). For individual companies, these figures will be impacted by a variety of issues that are unique to each insurer, but the point is that every fixed income investor is feeling significant pain due to rising interest rates.

Most risk pools utilize GASB accounting and therefore the fall in bond prices has had a significant impact on surplus. I work with a number of risk pools around the country, and there have been a number of discussions about the sizable unrealized losses. A key element to the rise in interest rates are that the losses are “unrealized”.

For the long term health of the surplus of the pool, it is important that those losses do not become realized in a significant way. Ultimately, by holding the securities, they will mature and the unrealized losses will evaporate. For those with shorter duration portfolios, the maturities will come more quickly and there will be greater opportunity to reinvest in the prevailing higher interest rate environment. Those pools with longer duration profiles will have to wait longer for values to recover. However, all investors will benefit from significantly higher reinvestment rates which will help improve investment income for the future.

One of the challenges many pools face is that premiums typically come in infrequently and in large amounts. As a result, the portfolio is typically the main source of ongoing cash inflow throughout the year. In a year that has proven for many pools to be challenging, particularly the Property & Liability pools that face increased claims costs and a hard reinsurance market, planning for cash needs has become very important. For many years when interest rates were low, if cash was needed quickly, bonds could be sold for nominal losses or, more likely, meaningful gains.

Today if a significant amount of cash is needed, selling bonds will typically move those losses from “unrealized” to “realized”. Significant realized losses may do long term damage to surplus of a pool. We are encouraging our clients to be thoughtful about possible cash needs. With the shape of the yield curve and the overall higher level of interest rates, investors can finally earn something on cash even if they hold it in the money market. For several clients we have established very short term portfolios to invest in assets and act as an enhanced cash strategy. As of the market close on 10/24/2022, a 1 month T-Bill has a yield of 3.4%, a 3 month T-Bill has a yield of 4.0% and a 6 month T-Bill has a yield of 4.4%. An average of those investments would provide an investor with a yield of 3.9% in investments that are very short maturity and highly liquid.

Not all realized losses are bad, and throughout 2022, we have realized some modest levels of losses for risk pool portfolios. Those losses have been typically driven by our views on the economy and credit. We expect a recession is coming, and earlier this year, especially over the summer when yields had fallen some, we selectively reduced exposures to credits that we felt would likely underperform in a recessionary environment. We strive to be thoughtful about these losses, but we feel they will set up portfolios to perform better should a recession occur.

So, in short, unrealized losses are something to carefully monitor, but with some planning, realization of losses can likely be kept to a minimum. Further, some modest level of realized losses may not be an entirely bad thing, if the losses lead to a long-term benefit to the portfolio and ultimately to the pool.

1 - AM Best Special Report: Rising Interest Rates Leading to Large Unrealized Losses on Fixed Maturities. 10/10/2022

SAA: With volatility as high as it is today, what fixed income sectors does AAM find attractive today for risk pools?

AAM: As I mentioned before, we expect a recession is coming, and we will experience more periods of volatility in the markets. Against that backdrop, we are focusing on higher quality assets in portfolios. However, risk pools need investment income, so we typically have a relatively low allocation to US Treasury securities. Away from US Treasuries, we are focused on Asset Backed Securities (ABS), Agency mortgage backed securities (Agency MBS) and taxable municipal bonds.

On the short end of the yield curve, we have invested in senior tranches of ABS. This allows us to take advantage of some spread widening in the sector combined with relatively higher Treasury yields for short maturities. The ABS sectors we typically invest in traditionally have less volatility through cycles.

As we invest further out the maturity spectrum, we have recently been more involved in a sector that has long been unattractive in our view – Agency MBS. The Fed had been buying so much of the sector as part of their Quantitative Easing program, that there was very little excess value left in the sector. Further, using excess returns of the Bloomberg Aggregate Index, Agency MBS has underperformed US Treasury securities in each of the prior two years. By 9/30/2022, Agency MBS had underperformed US treasuries by over 3%(2) in 2022, and this created an opportunity in our view. Agency MBS is a government guaranteed sector, and we can invest in the sector today with premiums over Treasuries (or spreads) that are near their widest level of any period in the past five years(2).

The final sector we are adding to today, primarily for our longer cash flow needs, is Taxable Municipal securities rated AA and AAA. For our risk pool clients, tax-exempt securities almost never make sense, but the high quality Taxable Municipal market offers yields comparable to high quality Corporate bonds. Also, we expect Taxable Municipal securities will be less volatile than corporate bonds during periods of market turmoil.

We will add to other sectors such as corporate bonds opportunistically in this environment, but we want to be sure the yield is especially attractive.

2 - Source: Bloomberg

SAA: With recent turmoil in the UK markets, how are you thinking about liquidity in US markets?

AAM: The recent turmoil in the Gilt market (the equivalent of the US Treasury market in the UK) was eye-opening. From September 19 through September 27, the 10 year Gilt rose from 3.14% to 4.1%, before falling to 3.87% on October 4 (source: Bloomberg). As the market swung significantly, liquidity deteriorated and levered investors were forced to sell other assets to meet margin calls. The experience in the Gilt market is also a good reminder to investors that there are always pockets of leverage and interconnectedness that may not be apparent until there are large, unexpected market swings.

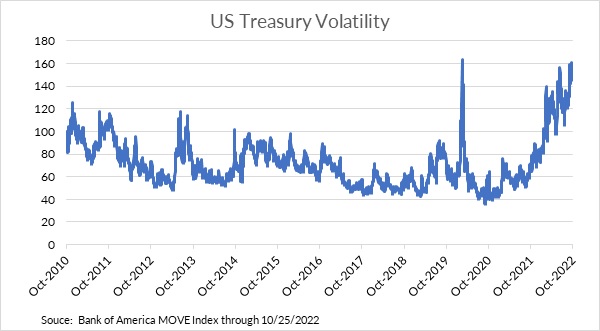

We have not seen that type of volatility in the US bond market yet, but volatility is certainly elevated. Except one day in March 2020, US Treasury volatility is the highest it has been since the depths of the Great Financial Crisis. See Exhibit 1 below.

This increase in volatility is one factor that has started to impact liquidity in US markets. Contributors to the volatility, and ultimately to reduced liquidity in the US Treasury market include the Fed’s reduced purchases of securities (Quantitative Tightening), uncertainty about the Fed’ path of monetary tightening and overall investor concern, among others.

It has become apparent that market liquidity is reduced, particularly in very large order sizes. For medium sized trades, such as the size we typically transact at AAM, or smaller, liquidity is still present in the market. However, we expect liquidity will continue to deteriorate across all trade sizes if the economic outlook worsens.

For risk pools, there are two immediate implications of reduced liquidity. First, if there is a situation where cash is needed quickly by the pool, the cost to transact in the market will be elevated. Said differently, losses may be even more significant than expected. Again, being thoughtful about cash is especially important in this environment.

The second implication for risk pools is that the ability to transition a portfolio to take advantage of opportunities in the market becomes more difficult when liquidity disappears. So even if there is a great investment idea, or if a pool wants to rebalance, it may be difficult to do so if liquidity deteriorates further.

Positively, if liquidity does deteriorate further, pools that have excess cash can be a provider of liquidity. In periods of stress and high illiquidity providers of liquidity can often find tremendous relative value opportunities. Again, we do not feel that liquidity has deteriorated significantly for our clients’ portfolios, but it is something we are monitoring more closely.

Disclaimer: The contents of this commentary are intended for educational purposes only and are not intended to be relied upon as a forecast, research or investment advice nor should it be considered a recommendation, offer or solicitation for the purchase or sale of any security or to adopt a specific investment strategy. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. All opinions expressed in this newsletter are subject to change without notice. Nothing in this report should be considered tax or legal advice and investors should contact their tax professional for information regarding their tax situation.

Source: Strategic Asset Alliance, AAM - Insurance Investment Management. The information contained herein has been obtained from sources believed to be reliable, but the accuracy of information cannot be guaranteed.