March 23 - 24, 2022

March 23 - 24, 2022

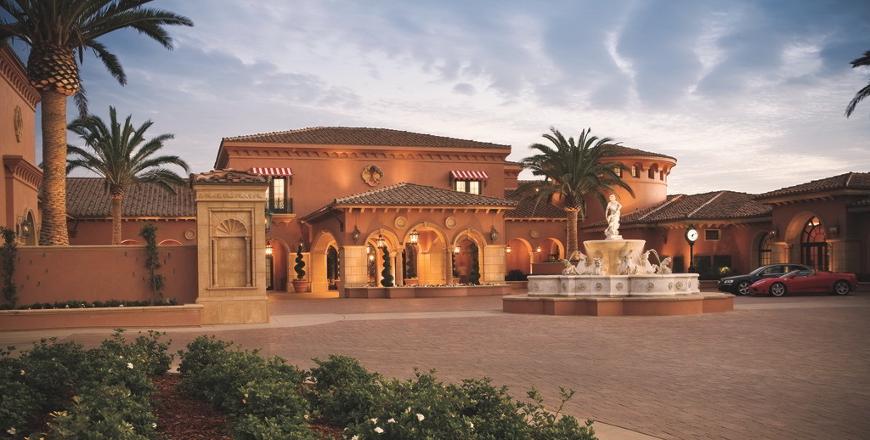

San Diego, CA

Learn More / Register >>

- Risk Pool Peer Database

- Key Issues: Q3 Review & Q4 Outlook

- Trustees: Fulfilling Investment Duties

- Case Studies: Pools Investment Seminar

- Investment Policy: Best Practices

- NLC-RISC 2023: Governing Your Pool’s Investment Process

- Investment Responsibilities of a Risk Pool’s Governing Body and Its Individual Members

Case Studies: Pools Investment Seminar

The Case Studies presented at SAA’s Risk Pooling Seminar has been lauded for their clarity, applicability and usefulness.

We hope these sample case studies from previous Pool Seminars provide better insight into the type of issues addressed at the conference, along with how attendees are able to collaborate with peers. You can view prior Insurer Investment Forum case studies here.

The next Insurer Investment Forum XXII will be held on March 23 - 24, 2022, with the Investment Seminar for Gov't Risk Pools taking place on the afternoon of March 23, 2022.

A Tale of Two Pools: Risk Asset Allocation

A Tale of Two Pools: Risk Asset Allocation

The Board members from two governmental pools continue to grumble about low, single-digit fixed income returns. Yet, they also remain concerned about the implications should rates rise sharply and unexpectedly as the Fed’s tapering program ends, Europe slowly recovers, and geopolitical tensions ease.

Although more volatile, the Board members generally agreed that risk assets had a significantly better long term risk/reward profile.

Do you believe both Pool#1 and Pool #2 have an argument to increase the risk asset allocation? Why? Why not?