Allocate: Strategic Asset Allocation

Over 90% of your company's investment performance and returns will be determined by the allocation decision.

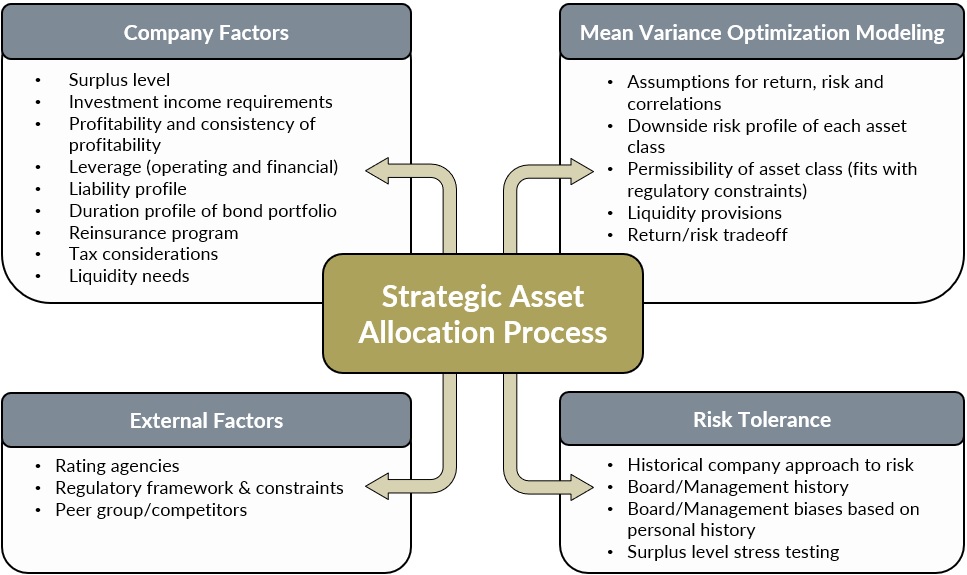

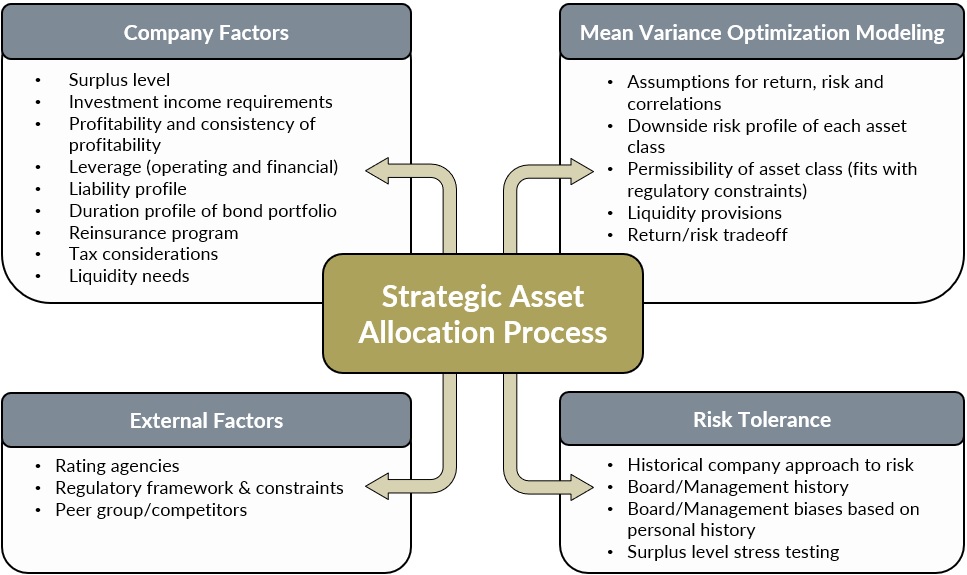

SAA will review the impact of different allocations in a risk management framework by modeling various asset class combinations for clients. If you'd like to discuss your company's Asset Allocation or request a sample analysis, contact us here.

SAA uses an asset allocation approach providing detailed asset allocation strategies designed to maximize return on risk adjusted capital for any given product line. The analysis is performed over different interest rate and economic scenarios.

Asset allocation is integrated with your product strategies. SAA believes that any asset allocation analysis must be tested inside an asset / liability management model to determine how asset and product strategies will interrelate to impact your bottom line.

Allocate: Strategic Asset Allocation

Over 90% of your company's investment performance and returns will be determined by the allocation decision.

SAA will review the impact of different allocations in a risk management framework by modeling various asset class combinations for clients. If you'd like to discuss your company's Asset Allocation or request a sample analysis, contact us here.

View Asset Allocation Process

View Asset Allocation Process

SAA uses an asset allocation approach providing detailed asset allocation strategies designed to maximize return on risk adjusted capital for any given product line. The analysis is performed over different interest rate and economic scenarios.

Asset allocation is integrated with your product strategies. SAA believes that any asset allocation analysis must be tested inside an asset / liability management model to determine how asset and product strategies will interrelate to impact your bottom line.