March 23 - 24, 2022

March 23 - 24, 2022

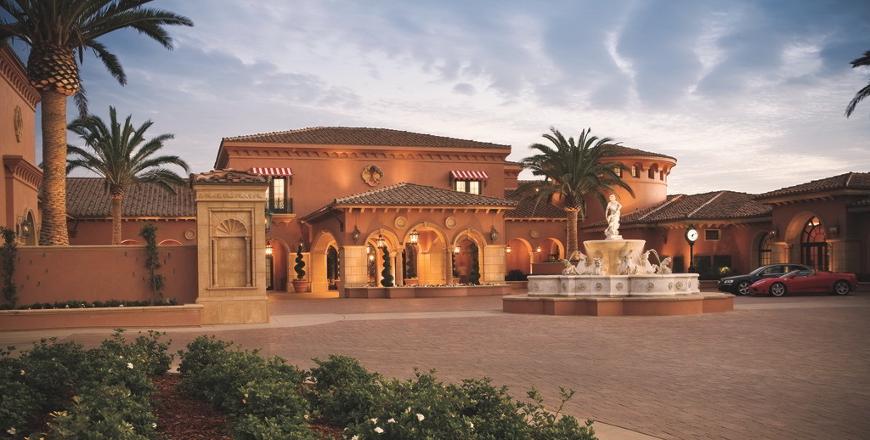

San Diego, CA

Learn More / Register >>

Insurer Investment Forum XXI: Presentations

For your reference, below are PDF copies and video recordings of the presentations for this year's agenda.

Please let us know if you have any questions.

The Yin and Yang of Risk Assets

The Yin and Yang of Risk Assets

Alton Cogert, President & CEO, Strategic Asset Alliance

The Fed’s monetary policies have thrown down the gauntlet. ‘Take more risk’ they say, to help improve the economy. No matter what we may think about Fed policy, we must invest taking it into account. But, how much risk is too much? Or too little? How can your insurer best determine its risk appetite? And, where might you safely look for improved risk adjusted returns?

Environmental. Social. Governance.

Environmental. Social. Governance.

Nathan Simon, Director, Strategic Asset Alliance

It’s not coming. It’s already here. Investment managers are flogging investment portfolios focused on Environmental, Social and Governance issues. Large pension funds and many non-US insurers are focused on it. But, not all E, S and G ratings are alike. And a positive E, S or G for one investor, could be a negative for another. Is their value in ESG? What should you be asking your manager about ESG?

“Lower Rates for Longer Playbook” - Part I

“Lower Rates for Longer Playbook” - Part I

Dan Smereck, Managing Director & Principal, Strategic Asset Alliance

The good news is that we can finally have confidence in our interest rate forecasts. The bad news is that we can finally have confidence in our interest rate forecasts. The Fed has said to expect rates to be near zero for the next two to three years. And, Fed Chair Jay Powell’s term doesn’t end for another seven years. With practically every insurer’s book yield greater than their market yield, Mr. Powell has just told you to expect lower investment income. Financial markets are getting more complex every day. With ‘lower rates for longer,’ the markets just became more perilous. How can your insurer or government risk pool develop its own effective playbook in this environment?

The Evolution of the Core Portfolio: EMD, High Yield & Securitized Assets

The Evolution of the Core Portfolio: EMD, High Yield & Securitized Assets

Peter Cornax, SVP - Senior Insurance Investment Strategist, AllianceBernstein

As the global economy continues its road to recovery from the pandemic, we’re not out of the woods yet. However, there are reasons to be optimistic as we progress through 2021, and insurers will need to increase their risk-asset appetites to generate strong excess returns. It won’t be as simple as adding to IG global credit. The evolution of the core portfolio calls for expanding opportunity sets and pursuing selective opportunities. The three focus areas of yield enhancement in the public fixed income sectors are EMD, high yield and securitized assets.

US Private Placements – Enhancing Yield Within Investment Grade Fixed Income

US Private Placements – Enhancing Yield Within Investment Grade Fixed Income

Charles Dudley, Head of Private Credit US, Allianz Global Investors

As US insurers continue to search for yield beyond investment grade corporate bonds, the US private placement market (“USPP market”) can offer insurers both yield enhancement and structural benefits when compared to public investment grade corporate bonds. In this session, we will discuss the USPP market and highlight that although the USPP market may be less well known than traditional investment grade fixed income, the market for these privately issued bonds is deep and has been in existence for over 30 years, with both large-cap issuers participating in the space, as well as familiar organizations like the MLB and NBA. Finally, we will discuss three of the primary benefits of investing in US Private Placements when compared to public debt: additional yield and total return, increased covenants and protection, and lower realized credit losses in the event of a default.

Bond Duration Got You Here. Now What?

Bond Duration Got You Here. Now What?

Eric Stein, CFA, Chief Investment Officer - Fixed Income, Eaton Vance Management

With real risks for bonds on the horizon, the “lower rates for longer” playbook requires some new thinking. A prolonged period of falling rates drove returns in duration-heavy markets segments. Now, the combination of historically low yields and an unprecedented level of globalstimulus is poised to deliver renewed growth prospects, but also the potential for inflation and a steepening yield curves. What’s a bond investor to do? Hear Eric Stein’s perspective on the current state of global fixed income markets, as well as unfolding opportunities in a reflationary environment.