Banking, CMBS Stressors Impacting Insurer Investments

We spoke with Income Research + Management to discuss how the commercial real estate (CRE) market has been the latest sector to come under the microscope, as well as how insurance companies might be able to navigate the pressures facing this market.

Rob Lund

| Senior Client Portfolio Manager |

Income Research + Management

rlund@incomeresearch.com | www.incomeresearch.com/

SAA: Following the collapse of Silicon Valley Bank (SIVB) and additional stresses in the banking sector, the commercial real estate (CRE) market has been the latest sector to come under the microscope. The interdependencies between CRE and regional banks, coupled with weakness in the office sector and higher interest rates, have been cause for concern for commercial mortgage-backed security (CMBS) investors.

What is the current state of the CRE market?

IR+M: Commercial real estate (CRE) has garnered headlines recently with growing concern of a spillover from the banking sector crisis to CRE. This is after investors were already wary of higher rates, rising defaults, higher debt service costs, and lower CRE valuations.

Bolstered by low rates and continued price appreciation, CRE transaction volumes remained steady over the last few years despite some slowdown during the COVID pandemic. However, once the Federal Reserve (Fed) began hiking interest rates in March 2022 to combat inflationary pressures, higher mortgage and cap rates prevailed. Borrowers are now facing higher mortgage costs, changing demographics, a reassessment lower in property values, and tighter lending conditions.

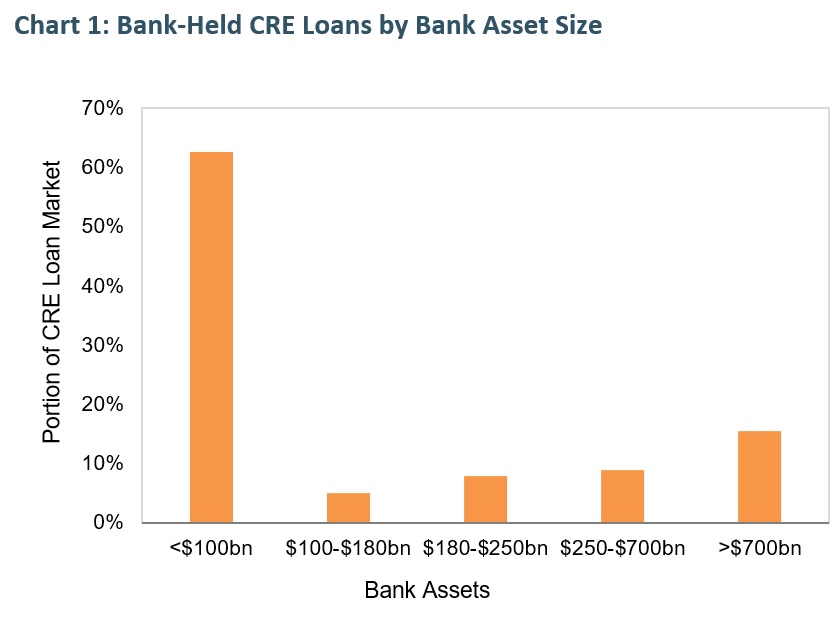

The US banking sector’s importance to commercial real estate cannot be ignored as it finances roughly 40% of the total CRE debt outstanding. Larger-sized banks’ exposure to CRE loans is relatively small, however, a meaningful number of smaller-sized regional banks, particularly those with less than $100 billion in assets, have CRE exposures of 25% or more of their overall outstanding loans. As a result of the banking crisis, new regulations on banks could lead to more realized losses. Banks were natural buyers of highly rated CMBS tranches in their securities portfolios. Future regulations could force banks to hold more liquid, shorter duration, and lower risk securities, and result in the loss of a meaningful buyer of CMBS securities. This could pressure spreads, especially in lower-rated tranches, and ultimately the underlying CRE loans, as market participants demand a greater risk premium for holding these assets.

In addition to the banking sector’s impact on CRE, office exposure within CMBS transactions has garnered increased attention and is responsible for a large share of market stresses. Not surprisingly, the sector is facing many headwinds from transitioning from the COVID-driven work-from-home model into today’s hybrid world. Fundamentals have been challenged with the record pace of rate hikes, hiring freezes and tech sector layoffs, and a potential impending recession. This has resulted in slower rent growth – which has fallen to just 1% annually – and higher vacancy rates – above both pre-COVID levels and the 2010 peak.

At IR+M, we are mostly exposed to CRE through our CMBS market exposure, which represents more than just office properties. The CMBS market represents only 10% of the total CRE market, down from almost 35% of outstanding CRE loans in 2007.

SAA: How can CMBS hold up despite broad pressures on CRE?

IR+M: CMBS can hold up despite broad pressures on CRE thanks to its diversified pool of assets and its structural advantage.

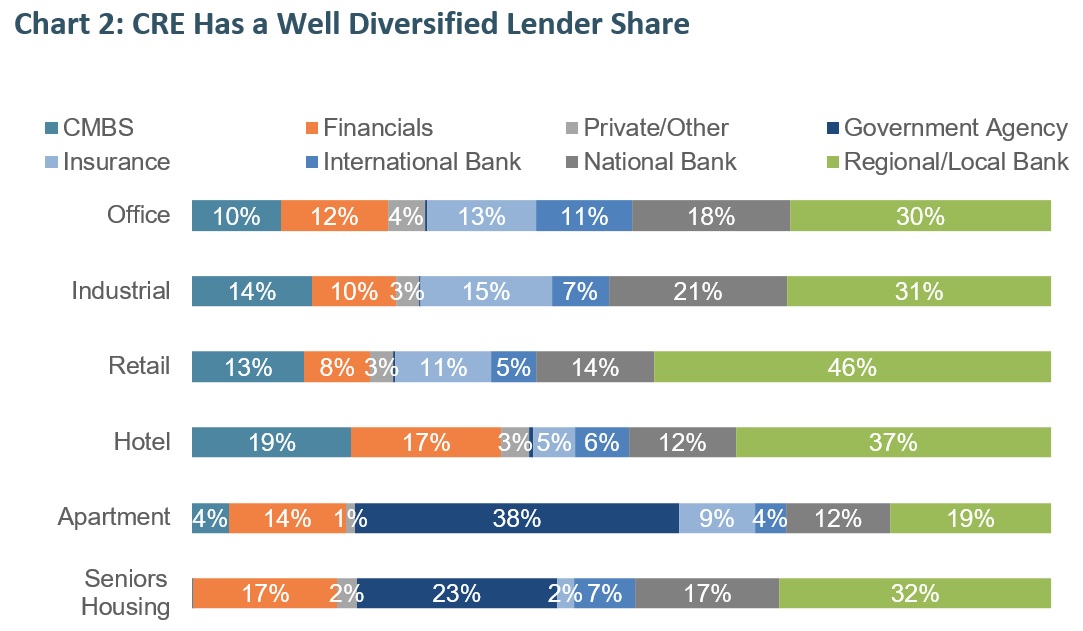

At IR+M, we prefer to invest in the largest segment of the non-agency CMBS market, conduit CMBS trusts, where the bond is backed by a well-diversified pool of CRE loans across a variety of property types and geographic areas, dampening the risk from any one specific sub-sector of the market and limiting the exposure to single default events. While the broader CRE market was under stress during the GFC, today’s concerns are more idiosyncratic with an emphasis on office space. Thus, conduit’s higher diversification and relatively contained issues should insulate investors who stay up in the capital structure against losses.

CMBS has structural benefits. The majority of CMBS trusts originated post-GFC have included senior tranches that are structured with a minimum subordination of 30%, typically with a 30-50% credit enhancement. This protection is in addition to the underlying borrower’s equity, which exists outside of the trusts, absorbs any losses prior to bondholders in a property liquidation scenario. Additionally, the amount of credit enhancement for senior tranches can also increase over time as principal payments are made.

Lenders who went through the GFC learned that loan modifications and extensions limit liquidation losses. Regional banks, in particular those with outsized CRE exposures, will likely work with borrows to extend loans and modify terms as opposed to forcing liquidation – this serves to keep overall property values in a healthy position.

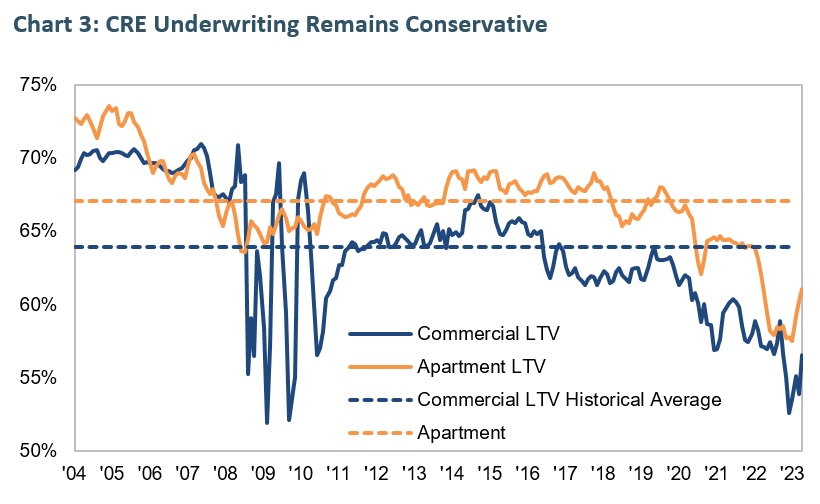

Furthermore, CRE loans backing conduit CMBS are better positioned to withstand a weaker market cycle than the loans originated pre-GFC. Underwriting standards on CRE loans have tightened significantly since 2006-2007 and GFC losses peaked at 11%. Loan-to-value (LTV) ratios on recently originated loans are 10+ points lower, which provides a meaningfully higher equity cushion to buffer potential valuation declines. This, combined with years of property value growth, limited foreclosures and liquidation activity, indicate CRE loans backing conduit deals are starting from a relatively healthy place.

SAA: How can insurers navigate potential cracks within CMBS?

IR+M: Insurers can navigate potential cracks within CMBS by maintaining diversified portfolios of high-quality loans senior in the capital stack, as these securities are structurally built to withstand the most adverse of scenarios. Amid present market concerns around CRE, we believe CMBS spreads offer an attractive entry point for insurers, however, security selection and credit analysis must be heavily emphasized. Seasoned securities with low office exposure, favorable geographic footprints, and high levels of defeasance offer attractive risk/reward characteristics for insurers.

Investing in the senior, AAA-tranche allows insurers to improve the overall credit quality of their fixed income portfolio based on the National Association of Insurance Commissioners (NAIC) designations ahead of a potential looming recession which could lead to ratings deterioration and higher risk-based capital charges. As investors within the AAA-tranche, the primary concern is extension risk, not principal loss given the strength of the structure and significant credit enhancement that can build as a deal seasons and de-levers.

Sources: Bloomberg as of 7/28/23 unless stated otherwise. Chart 1: Bank of America as of 12/31/22. Chart 2: Morgan Stanley as of 03/10/23. Chart 3: Morgan Stanley as of 04/28/23, but published on 06/21/23. Copyright © 2023 Bank of America Corporation (“BAC”). The use of the above in no way implies that BAC or any of its affiliates endorses the views or interpretation or the use of such information or acts as any endorsement of the use of such information. The information is provided "as is" and none of BAC or any of its affiliates warrants the accuracy or completeness of the information. The views contained in this report are those of IR+M and are based on information obtained by IR+M from sources that are believed to be reliable but IR+M makes no guarantee as to the accuracy or completeness of the underlying third-party data used to form IR+M’s views and opinions. This report is for informational purposes only and is not intended to provide specific advice, recommendations, or projected returns for any particular IR+M product. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission from Income Research + Management. “Bloomberg®” and Bloomberg Indices are service marks of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited (“BISL”), the administrator of the index (collectively, “Bloomberg”) and have been licensed for use for certain purposes by IR+M. Bloomberg is not affiliated with IR+M, and Bloomberg does not approve, endorse, review, or recommend the products described herein. Bloomberg does not guarantee the timeliness, accurateness, or completeness of any data or information relating to any IR+M product.

Source: Strategic Asset Alliance, Income Research + Management The information contained herein has been obtained from sources believed to be reliable, but the accuracy of information cannot be guaranteed.