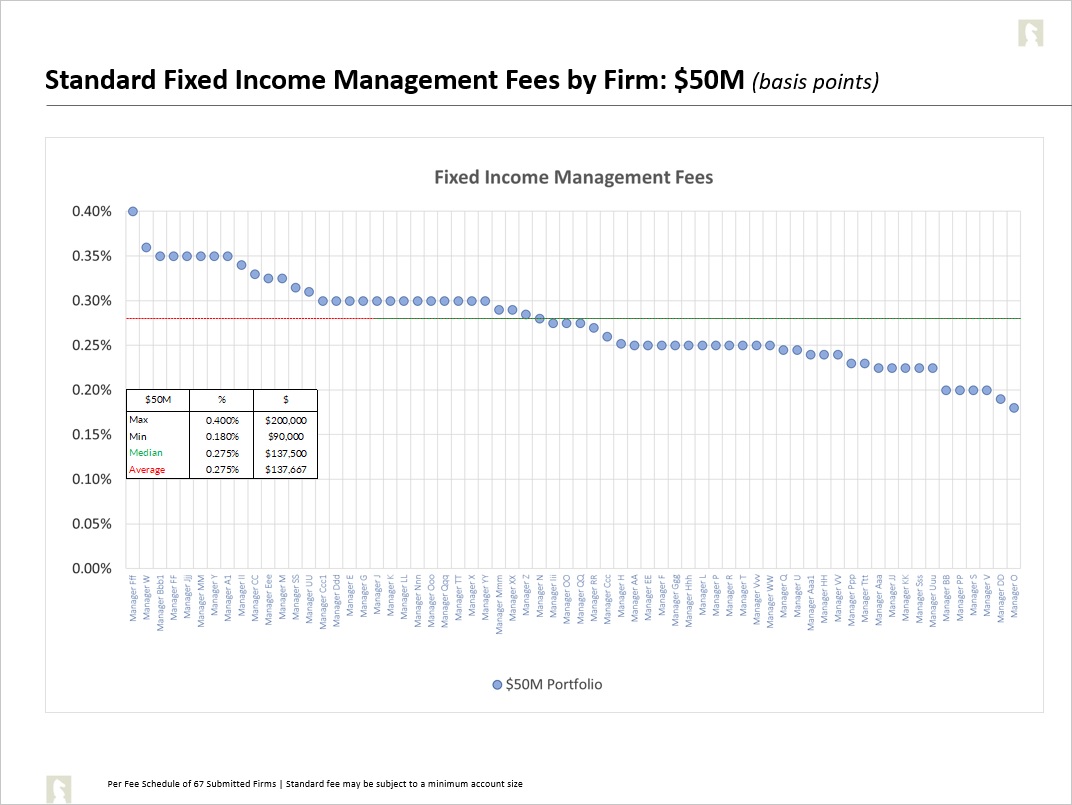

Fixed Income Mgmt.: Fee Comparison

As a resource for insurers, we've compared fixed income investment management fees, across various portfolio sizes, among managers in the insurance space.

Quarterly Investment Review for Insurers: Q1-2024

View PDFGlobal stock markets registered strong gains in Q1 amid a resilient US economy and ongoing enthusiasm and increased productivity prospects around Artificial Intelligence. Expectations of interest rate cuts also boosted shares although the pace of cuts is likely to be slower than the market had hoped for at the turn of the year which drove bond returns negative for the quarter.

Inflation remained a central concern for markets. Despite indications of diminishing inflationary pressures, unexpected high inflation readings tempered enthusiasm for imminent rate cuts. Both the US and eurozone reported inflation rates exceeding forecasts, raising alarms about the enduring nature of service sector inflation.

Despite record Q1 investment-grade (IG) corporate issuance (prior record issuance Q1 ’20), IG corporate spreads tightened -6 bps for the month and -9 bps for the quarter driven by strong demand to lock-in yields before the Fed’s rate easing cycle begins.